39+ can i claim mortgage interest on taxes

For mortgages taken out after. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Pdf Sovereign Bonds And The Does Regime Type Affect Credit Rating Agency Ratings In The Developing World Glen Biglaiser Academia Edu

You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

. However due to the Tax Cuts and Jobs Act the amount you can claim may be reduced. 20 x 20000 4000 However there. Ad Over 90 million taxes filed with TaxAct.

Web You can claim your Mortgage Interest on your home. Web If a lump sum amount was paid to reduce the interest rate on a mortgage only a pro-rated portion of that lump sum is deductible in the tax year it was paid. Ad Avoid penalties and interest by getting your taxes forgiven today.

Web If each taxpayer paid one-half of the mortgage and real estate tax expenses then each Schedule A should reflect one-half as deductions. Web To deduct mortgage interest you must be legally obligated to pay the mortgage a borrower and you must actually pay the interest. Ad Easy Software To Help You Find All the Tax Deductions You Deserve.

File your taxes stress-free online with TaxAct. Your mortgage lender sends you. Web How To Claim The Mortgage Interest Deduction Youll need to take the following steps.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home. Web The total mortgage interest you paid for the year is 20000. Look in your mailbox for Form 1098.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. If you are on the deed with someone else you should divide the amounts you paid and report them.

Homeowners who bought houses before. Web The mortgage interest tax deduction allows you to deduct the interest you pay on your mortgage from your income taxes. Both of you should attach a.

Filing your taxes just became easier. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way. With an MCC of 20 you would get a tax credit for 4000.

Web You can deduct mortgage interest paid on qualified home for loans up to 1 million or 500000 if married filing separately for loans taken out before 2018 or up to. The amount you can deduct is limited but it can be. File With TurboTax Live And Have An Expert Do Your Taxes For You Or Help Along The Way.

Web Most homeowners can deduct all of their mortgage interest. You dont have to be an. Web Then yes you can enter the interest paid on the mortgage.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Start basic federal filing for free. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

Ad Skip The Tax Store And Have An Expert File Your Taxes From The Comfort Of Your Home.

Mortgage Broker In Mornington Hastings Home Loans Mortgage Choice

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

Free Legal Assistance Available For Pennsylvania Remnants Of Hurricane Ida Survivors Helpline 877 429 5994 Legal Aid Of Southeastern Pennsylvania

Become One Of The Strongest Star Trek Fleet Command Facebook

Calculating The Home Mortgage Interest Deduction Hmid

:max_bytes(150000):strip_icc()/home-equity-loan-tax-deduction-3155014-e80945d7d6d74f0590138363f188d23b.png)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

How To Effectively Train My Investing Skill Quora

Mortgage Interest Deduction Bankrate

Mortgage Interest Tax Deduction 2022 What If You Forget

Landlords Understand Your Section 24 Tax Position

Maximum Mortgage Tax Deduction Benefit Depends On Income

Free 39 Estimate Forms In Pdf Ms Word

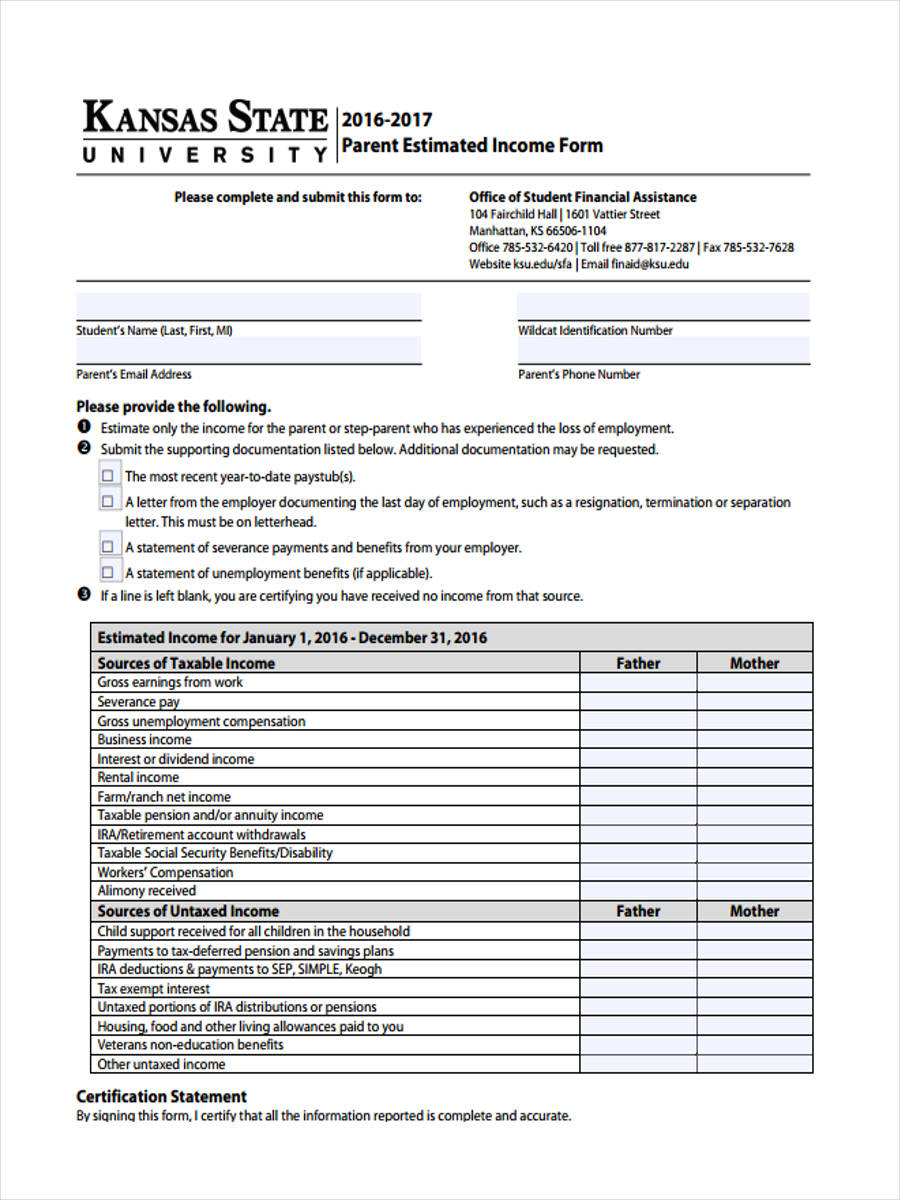

Business Succession Planning And Exit Strategies For The Closely Held

:max_bytes(150000):strip_icc()/TaxDeductibleInterest-10de394cbe27459ebb6f979a8f795083.jpeg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

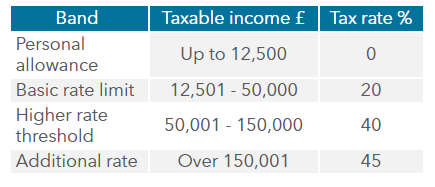

Uk Tax Archives The Evidence Based Investor

39 92ac Luella Road Sherman Tx 75090 Propertyshark

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service