18+ Home affordability

Ad Explore Quotes from Top Lenders All in One Place. Adjust the loan terms to see.

2

Ad Knowing How Much You Can Afford Is The First Step Towards Homeownership.

. Your mortgage payment should be 28 or less. Ad Compare The Best Mortgage Rates. This calculator can help you understand how much house you might be able to afford.

Ad Work with One of Our Specialists to Save You More Money Today. This material is provided for general and educational purposes only. Get The Service You Deserve With The Mortgage Lender You Trust.

Your loan term is how many years it takes to pay off your mortgage. Get Your Estimate Today. The home affordability calculator will also estimate your annual homeowners insurance costs and property tax percentage and your actual costs may be higher.

Use this calculator to see if you can afford it. Determine Your Monthly Mortgage Budget By Using Our Home Affordability Calculator Today. Lock Your Mortgage Rate Today.

The maximum DTI for conventional loans is 45. This calculator helps you estimate how much home you can afford. Instead the calculator sets a mortgage payment limit of 28 of your monthly income to account for.

By income Tell us your annual income your existing monthly debt load and your down payment amount. In the Bay Area 18 percent of home buyers could afford a home that costs a median 1495 million from April to June. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford.

Sample run of the US Historical Home Affordability Tool using 31 front-end DTI and 2 non-mortgage costs. Amount payable to the lending institution by the borrower or seller to increase the lenders effective yield. Simply enter your monthly income expenses and expected interest rate to get your estimate.

Set and achieve goals for your dream home and more. Other EMIs that you might have. Choose your loan term.

To calculate your affordability it will require you to input the following information. Lock Your Mortgage Rate Today. However Money Under 30s Home Affordability Calculator is a bit more conservative.

The amount of money you spend upfront to purchase a home. Principal Interest 1398. Top-Rated Mortgages for 2022.

Well tell you how much you can. Your debt-to-income ratio DTI should be 36 or less. Get the Right Housing Loan for Your Needs.

Find A Lender That Offers Great Service. Get Your Estimate Today. Begin Your Loan Search Right Here.

Most home loans require a down payment of at least 3. Ad Were Americas Largest Mortgage Lender. Ad Were Americas Largest Mortgage Lender.

Compare More Than Just Rates. LendingTrees home affordability calculator reflects the house price you can. To move in they would need a minimum income of.

The expected interest rate on the property you wish. Any more than 30 and a family is considered cost-burdened which means they. It may represent a payment for services rendered in issuing a loan or additional.

Your bank will then find the highest mortgage you can afford without increasing your debt-to-income ratio DTI beyond the limit. You can update these for a. This series reports changes in housing affordability for families and individuals both owners and renters at different price levels chances of.

It is not intended to provide. A 20 down payment is ideal to lower your monthly payment avoid. Washington DC May 19 2009--Nationwide housing affordability jumped 10 percentage points during the first quarter to its highest level since the series began 18 years ago.

Experts generally say that the maximum a family should pay for housing is 30 of their income. Your housing expenses should be 29 or less. Calculate Your Home Loan.

Compare Offers Side by Side with LendingTree. Mint is a free service. You may be able to afford a home worth 307110 with a monthly payment of 2117.

We offer a new home affordability estimate HAE that focuses on the share of housing stock that is affordable to certain households in the United States. Get The Service You Deserve With The Mortgage Lender You Trust. All you need to enter is the amount you can swing for housing costs each month.

Rates are At a 40-year Low. The tool only shows aggregate affordability in conditions where there is.

Interest Rates Affordability And Availability Half Of Non Homeowners Unlikely To Enter The Housing Market According To New Cpa Canada Study

Canadian Housing Affordability Worsens As Prices Of Brand New Homes Climb 11 Percent Georgia Straight Vancouver S News Entertainment Weekly

Greg Dewling Gregdewling Twitter

Consumers Voice Concerns About Food Safety

Attainable Housing Strategy And Resources Saskatoon Ca

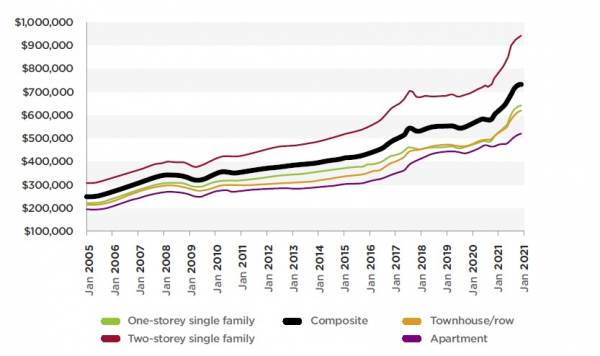

Canadian Home Prices Have Risen 70 Percent Or By 300 000 Since Justin Trudeau Took Power In 2015 Georgia Straight Vancouver S News Entertainment Weekly

2

Confidence Boost Canadians Reveal Highest Home Purchase Intent In Eight Years

Bcrea Suggests Doubling New Home Construction Will Make Prices Flat For A Decade Georgia Straight Vancouver S News Entertainment Weekly

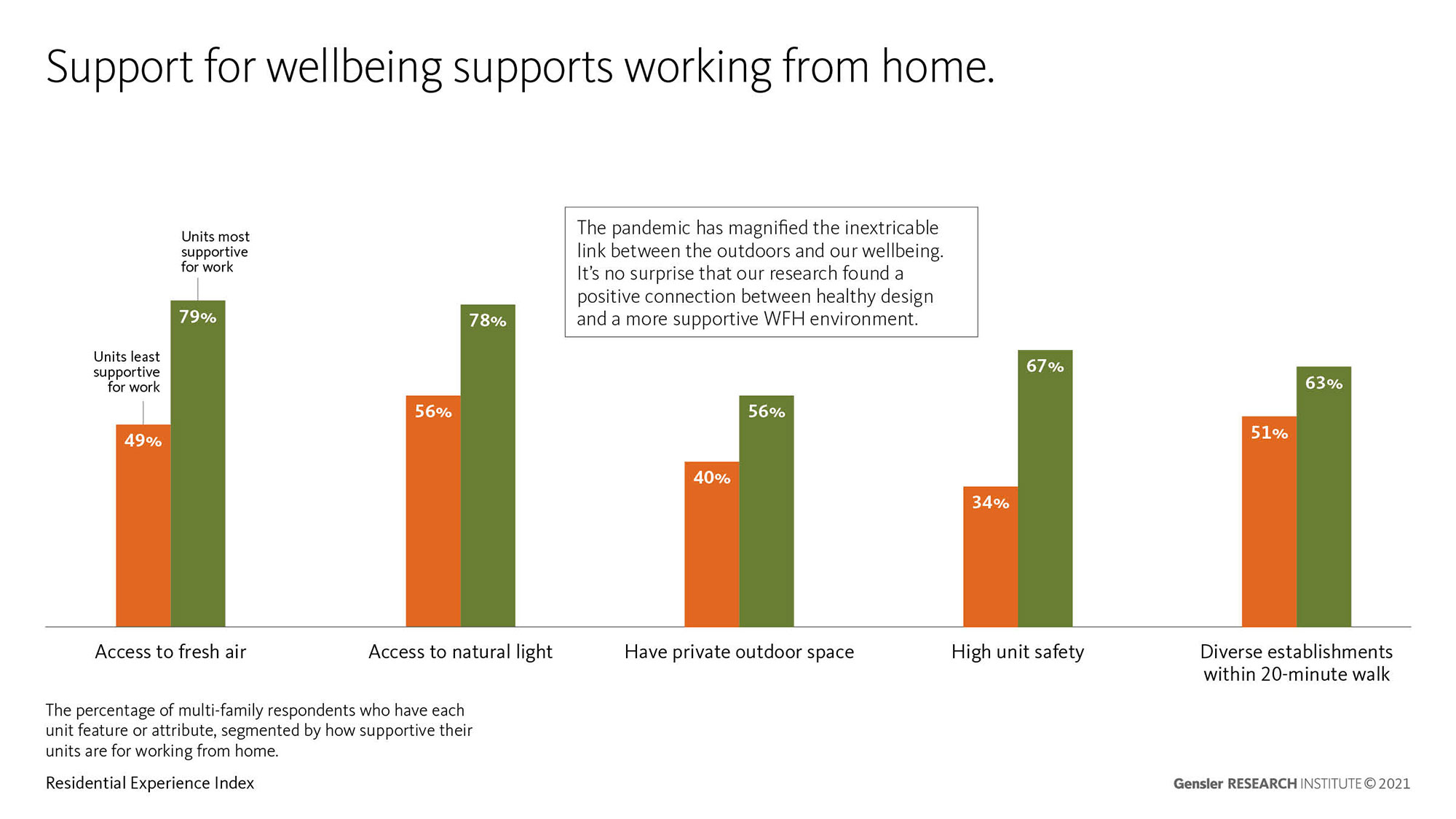

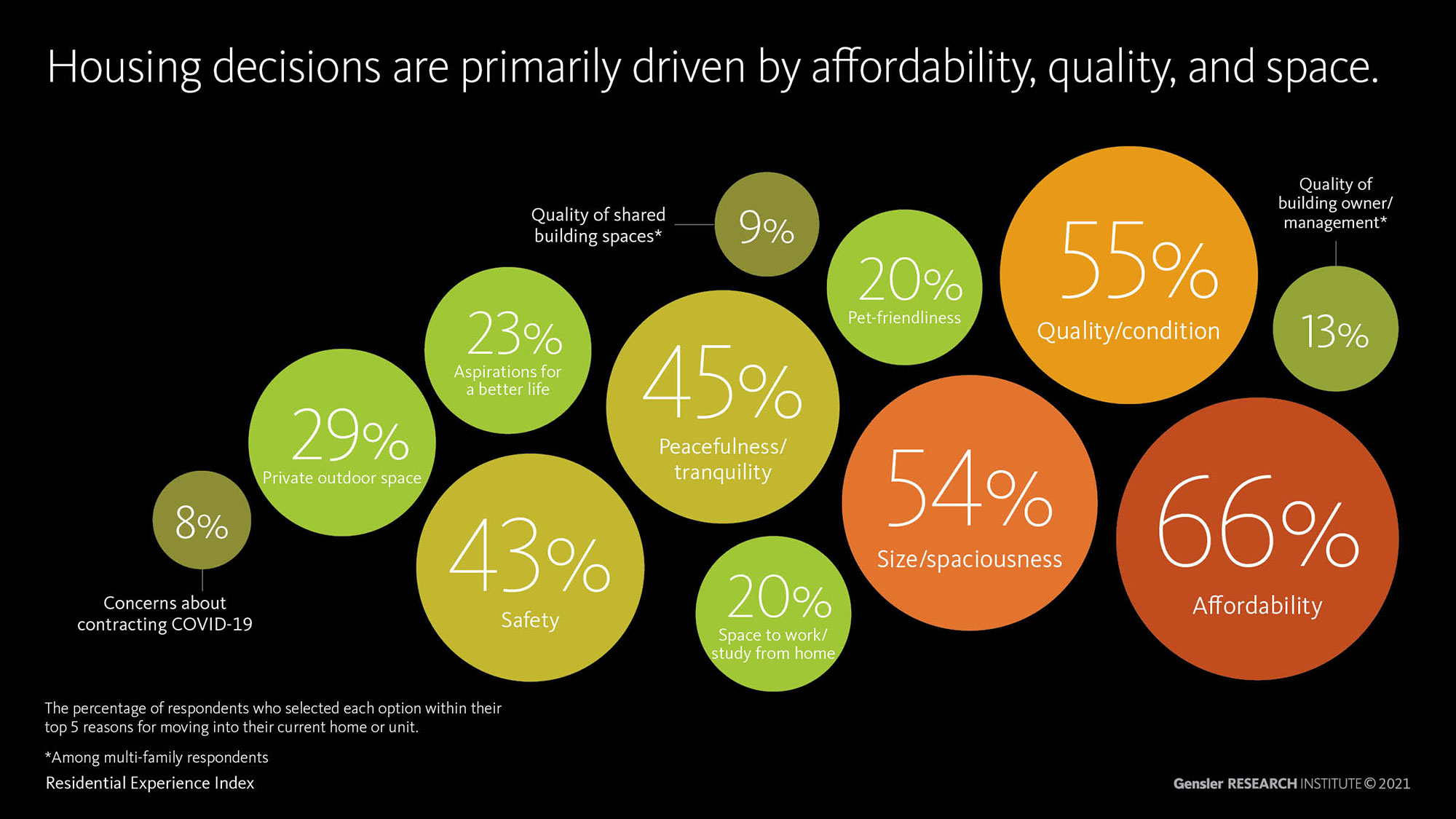

The Future Of Residential Design Must Balance Affordability Satisfaction And Experience

Affordability Page 2 Of 6 Realtor Com Economic Research

Trudeau Targets 2b In Spending To Fix Canada S Housing Supply Affordability Issues

The Future Of Residential Design Must Balance Affordability Satisfaction And Experience

What To Do If You Can T Afford Therapy Psych Central

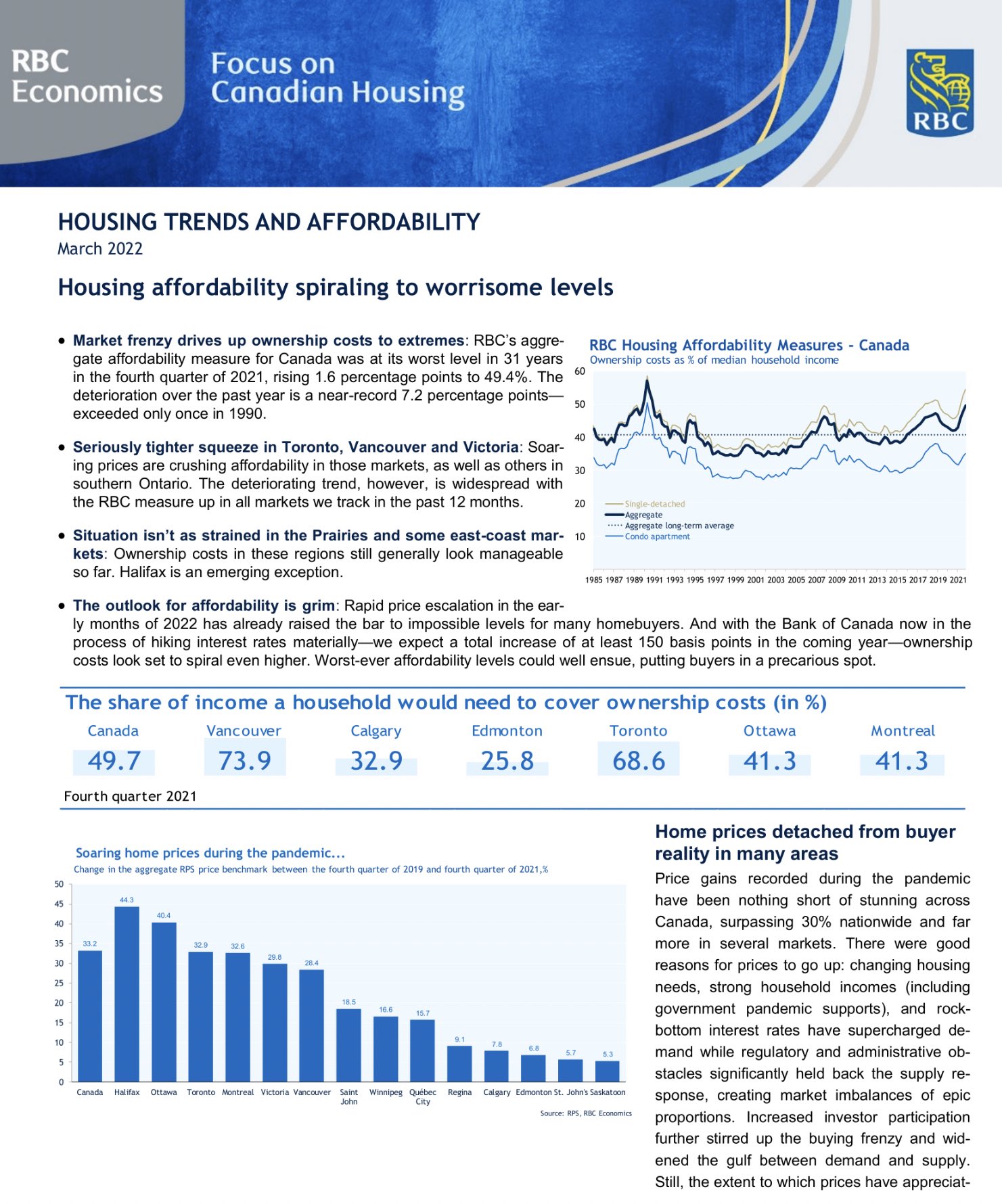

Rbc Measure Shows Canadian Housing Affordability Has Deteriorated To Worst Level In 31 Years Georgia Straight Vancouver S News Entertainment Weekly

Generation Rent 9 Million Canadians Settle To Rent Forever Finder Ca

Residential Market Commentary Week Of August 15 Bank Of Canada Latest Jo Anne Fleming On Linkedin